Del Rio auto title loans offer quick cash with faster approval and flexible terms, but come with higher interest rates and repossession risks if payments are missed. Rosenberg Title Loans provide a transparent, simple process for diverse credit profiles, making them a trustworthy option compared to other short-term funding alternatives. However, be aware of potential drawbacks like vehicle repossession and high-interest rates when considering Del Rio auto title loans. Thoroughly review terms and explore alternative options for reduced risk.

“Del Rio auto title loans have gained popularity as a quick financial solution. This article delves into the basics of these loans, providing insights on both their advantages and potential drawbacks. Understanding Rosenberg title loans involves grasping their mechanisms and assessing the pros, such as accessibility and faster approvals, against cons like high-interest rates and risk of vehicle repossession. By weighing these factors, borrowers can make informed decisions regarding Del Rio auto title loans.”

- Understanding Del Rio Auto Title Loans: Basics Explained

- Pros: Advantages and Benefits of Rosenberg Title Loans

- Cons: Potential Drawbacks and Risks to Be Aware Of

Understanding Del Rio Auto Title Loans: Basics Explained

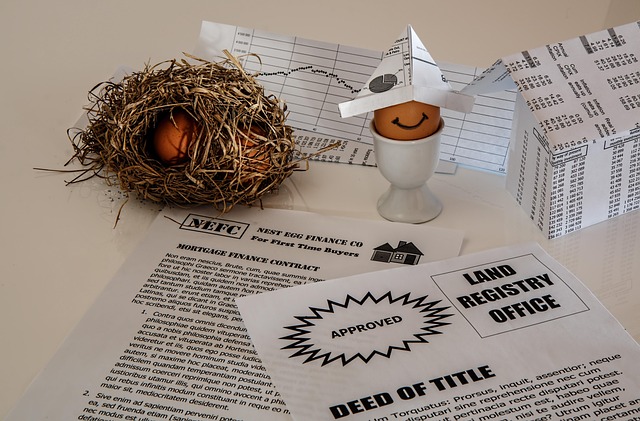

Del Rio auto title loans are a type of secured loan where the borrower uses their vehicle’s title as collateral. This lending option is designed for individuals who need quick access to cash, often with less stringent requirements compared to traditional bank loans. In this arrangement, the lender holds onto the vehicle’s title until the loan is repaid in full.

These loans are popular due to their potential benefits, such as faster approval times and more flexible repayment terms. For instance, Fort Worth loans based on auto titles can offer direct deposit of funds into the borrower’s account, providing convenient access to the borrowed amount. However, it’s crucial to consider the potential drawbacks, including higher interest rates and the risk of repossession if payments are missed. Understanding these aspects is essential when deciding whether a Del Rio auto title loan aligns with an individual’s financial needs.

Pros: Advantages and Benefits of Rosenberg Title Loans

Rosenberg Title Loans offer a unique financial solution for individuals seeking quick and accessible emergency funding. This type of loan leverages the value of one’s vehicle, providing an alternative to traditional banking options. The process is straightforward and efficient, appealing to those in need of cash promptly. Unlike Dallas Title Loans, which often have stringent requirements, Rosenberg Title Loans focus on speed and flexibility.

One of the primary advantages lies in their ability to cater to various credit profiles. This inclusivity means that even those with less-than-perfect credit history can apply and potentially gain approval for much-needed financial support. The benefits extend further, offering a simple and transparent title loan process, allowing borrowers to understand the terms clearly. This transparency fosters trust and ensures individuals make informed decisions regarding their financial needs, especially when compared to other short-term funding options.

Cons: Potential Drawbacks and Risks to Be Aware Of

When considering Del Rio auto title loans, it’s crucial to be aware of potential drawbacks and risks. Unlike traditional Fort Worth loans that offer a safety net of collateral, title pawn loans put your vehicle ownership at stake. If you fail to repay the loan on time, the lender has the right to repossess your vehicle. This can result in significant financial strain if you rely heavily on your car for daily commuting or work.

Moreover, high-interest rates are a common pitfall associated with title pawn loans. These rates can quickly escalate the total cost of borrowing, making it even harder to repay the loan fully. It’s essential to carefully review the terms and conditions before signing any agreements to avoid being caught in a cycle of debt. Alternatively, exploring other financial options like bank loans or credit unions could provide more favorable terms and reduce the risk of losing your vehicle.

When considering Del Rio auto title loans, it’s crucial to weigh both the pros and cons. While these short-term financing options offer benefits like quick cash access and flexible repayment terms, they also come with significant risks, including high-interest rates and potential vehicle repossession. Before deciding, thoroughly evaluate your financial situation and explore all alternatives to make an informed choice regarding Rosenberg title loans.