Del Rio auto title loans provide quick funding using vehicle titles as collateral, with less stringent requirements than traditional loans. State regulations protect consumers by setting interest rates, loan terms, and borrower rights, ensuring transparent pricing and fair assessment. In Texas, these loans are capped for protection, offer cancellation and early repayment rights, and facilitate smooth asset retention through the title transfer process.

“Discover the intricate world of Del Rio auto title loans and how state regulations play a pivotal role in consumer protection. This comprehensive guide breaks down the fundamentals of these loans, delving into the regulatory framework that shapes the lending landscape. We explore how these regulations balance accessibility for borrowers with safeguards against predatory practices. By understanding your rights and the lending limits set by the state, you can make informed decisions regarding Del Rio auto title loans.”

- Del Rio Auto Title Loans: Understanding the Basics

- State Regulations: A Framework for Protection

- Navigating Lending Limits and Consumer Rights

Del Rio Auto Title Loans: Understanding the Basics

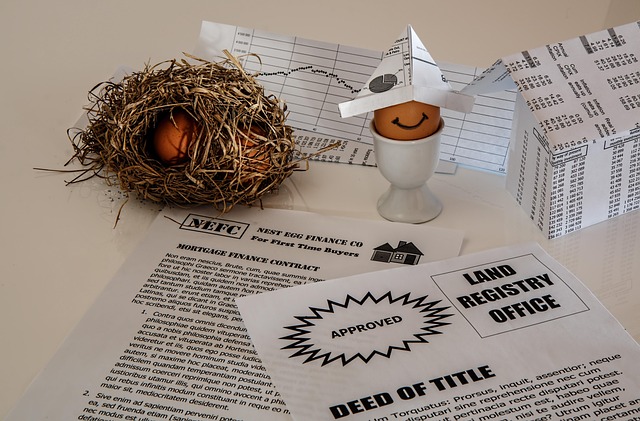

Del Rio auto title loans operate on a simple concept where an individual uses their vehicle’s title as collateral to secure a loan. This process is designed for convenience and speed, allowing those in need of immediate funding to access it quickly. Lenders evaluate the vehicle’s value, or vehicle valuation, to determine the maximum loan amount that can be offered. The applicant then repays the loan according to agreed-upon terms, with the title remaining in their possession throughout the repayment period.

Unlike other loan types, Del Rio auto title loans are less stringent regarding credit checks and employment verification. This accessibility makes them an attractive option for those who might not qualify for traditional bank loans, such as Houston title loans. However, it’s crucial to understand the loan requirements and potential risks associated with this form of lending.

State Regulations: A Framework for Protection

State Regulations play a pivotal role in protecting consumers engaging with financial services, including Del Rio auto title loans. Each state establishes its own set of rules and guidelines to ensure fair lending practices. These regulations cover various aspects, such as interest rates, loan terms, and borrower rights. For instance, many states have laws mandating transparent pricing, prohibiting abusive collection practices, and enforcing strict standards for credit checks.

When considering a secured loan like Del Rio auto title loans, state regulations provide a crucial framework. They ensure that lenders conduct thorough yet fair credit checks, offer flexible payments tailored to borrowers’ financial capabilities, and maintain clear communication throughout the loan process. This regulatory environment fosters trust between lenders and borrowers, promoting responsible borrowing and lending activities.

Navigating Lending Limits and Consumer Rights

Navigating Lending Limits and Consumer Rights for Del Rio Auto Title Loans

When considering a Del Rio auto title loan, understanding state regulations is paramount to ensuring a safe and beneficial borrowing experience. Texas has specific laws in place to protect consumers, setting limits on lending practices and establishing clear guidelines for borrowers. These regulations aim to prevent predatory lending by capping interest rates and ensuring transparency throughout the loan process. For instance, lenders must disclose all fees and terms clearly, allowing borrowers to make informed decisions about their financial obligations.

Borrowers also enjoy certain rights under these regulations, such as the right to cancel the loan within a specified timeframe and the ability to repay the loan early without penalties. This balance between consumer protection and access to fast cash, exemplified by options like Quick Funding, is what makes Del Rio auto title loans a viable solution for those needing immediate financial assistance. Moreover, the smooth transition of Title Transfer ensures that borrowers can maintain some control over their assets during the loan period.

In conclusion, Del Rio auto title loans operate within a structured regulatory environment designed to protect consumers. Understanding the basics of these loans, familiarizing oneself with state regulations, and knowing one’s rights and lending limits is paramount for making informed decisions. By navigating these aspects thoughtfully, borrowers can access needed funds while ensuring fairness and transparency in the lending process.