Del Rio auto title loans offer quick cash using a vehicle's title as collateral, with minimal paperwork and accessible options for less-than-perfect credit. Texas regulations protect borrowers by governing interest rates, loan durations, and collection methods, ensuring transparency and preventing predatory practices. Consumers should understand terms, including repayment conditions and penalties, to avoid risks while retaining control over their vehicles.

“In the competitive landscape of short-term lending, Del Rio auto title loans have emerged as a popular option for quick cash. This article provides an in-depth overview of Rosenberg title loans and the state regulations that govern them. We’ll break down the fundamentals of Del Rio auto title loans, explore Texas’s legal framework, and discuss consumer protections to ensure fair lending practices. Understanding these aspects is crucial for both lenders and borrowers navigating this alternative financing method.”

- Del Rio Auto Title Loans: Understanding the Basics

- State Regulations Governing Rosenberg Title Loans

- Consumer Protections and Fair Lending Practices

Del Rio Auto Title Loans: Understanding the Basics

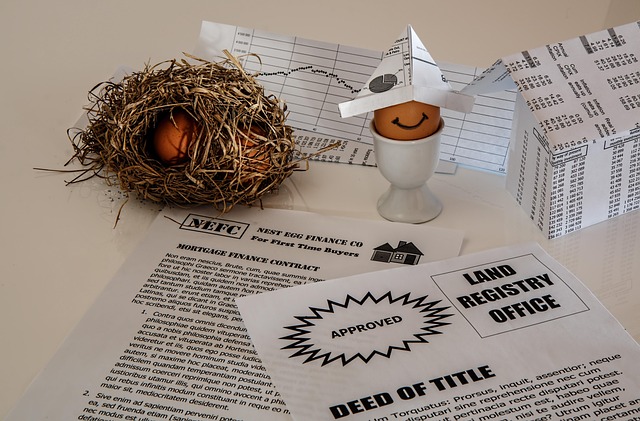

Del Rio auto title loans are a form of secured lending where borrowers use their vehicle’s title as collateral to secure a loan. This type of loan is an option for individuals who need quick access to cash, offering a simple and fast alternative to traditional bank loans. The process typically involves providing the lender with your vehicle’s registration, proof of insurance, and a valid driver’s license. A credit check might be conducted, but it’s not always a requirement, making these loans accessible to those with less-than-perfect credit.

Once approved, borrowers receive Same Day Funding, allowing them to gain immediate access to the funds. The loan amount is typically based on the vehicle’s value, and repayment terms are agreed upon during the application process. It’s crucial for borrowers to understand the terms and conditions thoroughly before signing, ensuring they can meet the repayment obligations without facing any penalties or repossession risks.

State Regulations Governing Rosenberg Title Loans

In the dynamic landscape of financial services, state regulations play a crucial role in safeguarding consumers and ensuring fair practices, especially within niche lending sectors like Rosenberg Title Loans. Texas, home to Del Rio auto title loans and other similar services, has established a regulatory framework that outlines the terms and conditions under which these loans can be offered and secured. The primary regulator is the Texas Office of Credit Regulation (OCR), responsible for licensing and monitoring various financial institutions, including those providing title pawn and secured loans such as semi truck loans.

These regulations cover several key aspects, ensuring transparency and consumer protection. They dictate the maximum interest rates, loan terms, and collection practices allowed for these secured loans. Additionally, they establish guidelines for the valuation of collateral, especially in cases involving vehicle titles, preventing excessive or predatory lending. By implementing such measures, Texas aims to foster a balanced market for Del Rio auto title loans and other secured financing options while protecting residents from potentially harmful lending practices.

Consumer Protections and Fair Lending Practices

When considering Del Rio auto title loans, it’s crucial to understand consumer protections and fair lending practices. These regulations are in place to safeguard borrowers from predatory lenders and ensure they receive transparent, just terms. In Texas, where semi truck loans and other types of secured financing are prevalent, state laws mandate that lenders provide clear explanations of interest rates, repayment schedules, and potential penalties for late payments or default. This ensures that individuals, especially those with limited financial literacy, can make informed decisions about borrowing against their vehicles’ titles.

Additionally, these regulations promote the preservation of a borrower’s asset—their vehicle. Unlike traditional loans where the lender may repossess the item if payments are missed, keep your vehicle with Del Rio auto title loans allows you to maintain control as long as you meet the agreed-upon repayment terms. This flexibility, coupled with quick funding options, makes these loans an attractive choice for those needing immediate financial support, whether it’s for unexpected expenses or business opportunities.

In conclusion, navigating Del Rio auto title loans requires understanding state regulations, consumer protections, and fair lending practices. By familiarizing yourself with these aspects, you can make informed decisions when considering a title loan in Rosenberg. Always remember to prioritize your financial well-being and explore all available options before securing any loan.